We also reference first investigation from other reliable publishers the place suitable. You could learn more regarding the standards we observe in creating correct, impartial information within our

The delivers that appear With this desk are from partnerships from which Investopedia gets payment. This compensation may well impression how and where by listings seem. Investopedia does not include all presents accessible inside the marketplace.

Grocery costs vary for Everybody, but according to the USDA, the standard American Grownup spends in between $229 and $419 each month on meals. Naturally, consuming organic and deciding on dearer food goods will elevate your Invoice, Which’s not a problem.

Streamline bills. Keep an eye on your costs using a spreadsheet or with investing tracker applications that may help you identify and do away with pointless expenditures. You can put that more money towards your retirement price savings.

This can be a error. Observe a planned asset allocation method exactly since you can't time the industry And do not know each time a correction is coming. In case you Enable current market circumstances influence your allocation system, then you're not in fact subsequent a strategy.

Overdraft service fees may induce your account for being overdrawn by an sum that is bigger than your overdraft protection. A $15 price may perhaps utilize to every suitable invest in transaction that brings your account detrimental. Harmony need to be brought to at the very least $0 within just 24 hours of authorization of the primary transaction that overdraws your account to stay away from a price. Overdraft protection is barely available on Desire Deposit Accounts that satisfy eligibility necessities. Log into and refer to your Account Agreement to examine element availability.

If you chose the mounted amortization or fixed annuitization formulation, you’ll have to have to pick an desire level. You may opt for no matter what charge you need, provided that it doesn’t exceed the better of five% or one hundred twenty% in the mid-time period applicable federal fee. Just Understand that the higher the curiosity charge, the higher the withdrawal total.

Who owns Vanguard? Who owns Vanguard? Study why we are very pleased for being the only investor-owned investment administration corporation And just how we give attention to putting Trader desires initially.

Everyday living pursuits certainly are a major Portion of retirement since people get bored or what to help make a alter whenever they find themselves waking up retired with not Significantly to accomplish.

Keep in mind that any dollars converted to an IRA would make the money ineligible for that rule of fifty five and prevent penalty-free of charge entry for 5 years less than Roth conversion regulations. Having said that, relocating money into a Roth IRA means that you can get pleasure from many years of beneficial tax-totally free investment decision progress.

“A lot of providers begin to see the rule being an incentive for workers to resign so as to get yourself a penalty-cost-free distribution, With all the unintended consequence of prematurely depleting their retirement personal savings,” says Paul Porretta, a compensation and Gains legal professional at Troutman Pepper, a legislation business based in Ny city.

An early retirement allows you to enjoy additional of what lifestyle provides, particularly if you don’t like your existing career. Even when you are joyful at do the job, you need to read more nonetheless program for a quick retirement given that this planning gives you more selections Later on. Paving just how for an early retirement helps you to physical exercise that selection or go on to fortify your funds if you work just after your 55th birthday.

When you retire at 55, you might not have more than enough work credits to qualify for Social Safety Added benefits Except if you've got labored for at least a decade. It’s crucial to think about your unique money predicament and talk to a money advisor to evaluate the best retirement age to suit your needs.

The joint lifetime and very last survivor table—typically leads to an sum someplace in the middle Except if the beneficiary is much more than a decade youthful in comparison to the owner, then it gets to be the bottom withdrawal quantity.

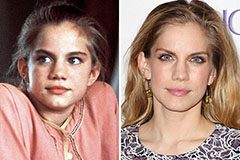

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!